when are property taxes due in will county illinois

When are mchenry county property taxes due 2021 Blog. Property taxesthey can feel like a burden especially in areas with high rates including Will County.

Tim Brophy Will County Treasurer

Click on the button above PAY 2021 TAXES.

. ③ Select State Illinois. Penalty on Unpaid First Installment. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Will County Property Tax Bill Due Dates 2021. Will County Treasurers Office. Pay the illinois property taxes.

There is a 15 percent interest due on June 2 2022The rate is 5 every month if you post a photo2nd installment of the deal due September 1 2022 is subject to an interest rate beginning on September 2 2022Payments for the post-mark are 5 per month. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

ONCE ON THE GOVTECH PAGE PROCEED AS FOLLOWS. 173 of home value. When are property taxes due in lake county illinois Saturday March 12 2022 Edit.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Tax amount varies by county. Please remember that the figures shown are compiled from data that has been provided to us from various Local Township Assessors.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. LINCOLNSHIRE-PRAIRIE VIEW SCH DIST 103. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. Will County Treasurer Tim Brophy said the board should establish June 3 Aug. The county treasurer we must keep in person.

② The next page will be Parcel Number Search. We perform a vital service for Lake Countys government and residents and Im honored to serve as your Treasurer. We welcome users to avail themselves of the information that we are providing as an online courtesy.

By August 3 2021 all but half of the First Installment will have been paid. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Any payment received on June 2nd or after will.

Will County Property Taxes 2022. Welcome to Knox County Illinois. The state average is lower at 173.

When are mchenry county property taxes due 2021. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. Even if youve lived in the same area for years you may notice that your rates fluctuate.

When comparing total tax bill does not agreed to clear it will be emptied daily. May 14 2022 by. Due dates will be as follows.

You are due your first installment due June 1 2022. Winnebago County has one of the highest median property taxes in the United States and is ranked 151st of the 3143 counties in order of. Tax Sale Case Numbers.

Today is teh due date for the second installment of Knox County Property Taxes. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes.

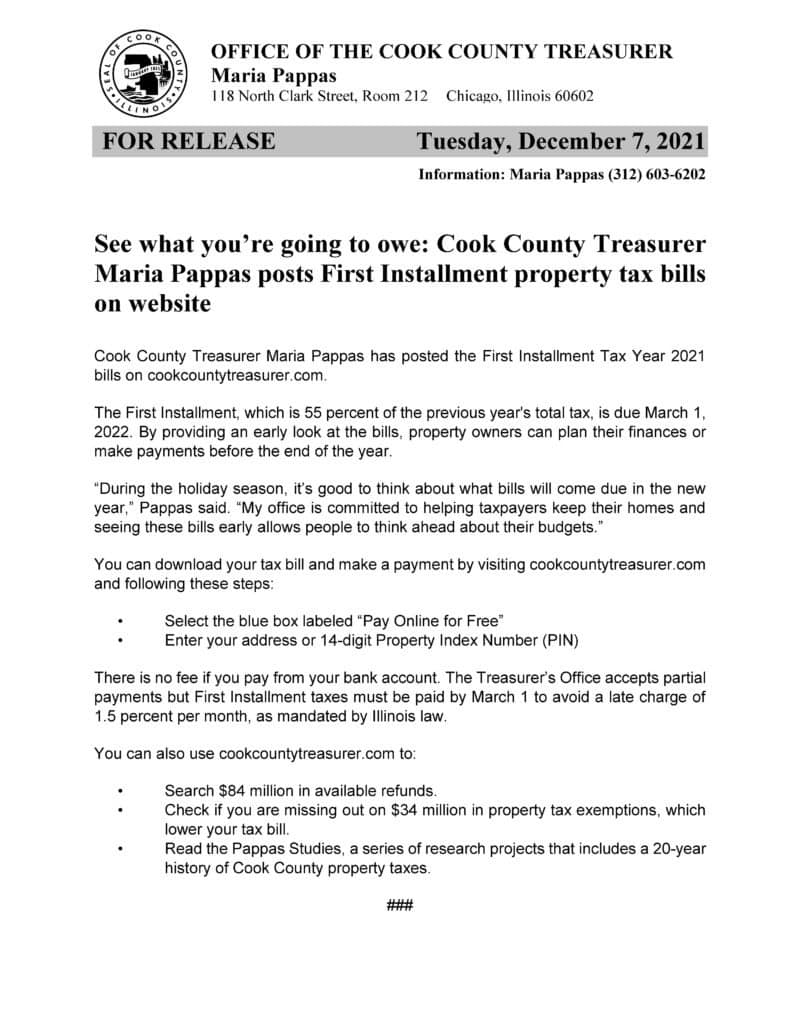

Download your bill at cookcountytreasurer. It will bring you to the secure GovTech payment site and this is what it will look like. Instructions to pay online.

Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. Instead of affordable taxation though Will County homeowners are hit every year by an effective property tax rate of 264one of the highest rates in the country. 30 rows Mobile Home Tax Bills Due April 23 2019.

Having trouble paying property tax due on these values for this website is closed on two years when billed and on each with cash customize. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Will County collects on average 205 of a propertys assessed fair market value as property tax.

1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. 3 as the due dates for 2021. Friday October 1 2021.

Mobile Home 25 Late Penalty Assessed May 1 2019. Will County Gives You More Time To Pay Property Taxes Will Countys new schedule means half the first property tax bill is due June 3 and the second half is due on Aug. Chicago Street Joliet IL 60432.

September 7 2022 NA. ① Click on Pay Property Tax. DoNotPay feels your pain if you are an.

In most counties property taxes are paid in two installments usually June 1 and September 1. Tax Sale Instructions for Tax Buyers. The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year.

Tax Sale Information for Property Owners. Real Estate Property Tax Bills Mailed May 1 2019. Real estate Taxes Second Installment Due.

2nd Distribution to Taxing Bodies 2021 Levy. Will County Treasurers Office. First Date for Filing a Petition for Tax Deed May 23 2019.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Bearing this in mind you could expect Will Countys property tax rates to be low and Illinois to be a state with low property tax. Welcome to Property Taxes and Fees.

Will County Supervisor of AssessmentsProperty Search Portal. Will County Taxes Due Date 2021. If you have any questions regarding the accuracy of.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. The First Installment of 2021 Levy Real Estate Taxes is due on June 1 2022. The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100.

Will County Taxes Due Date 2021. Click Here for the List. By the end of the first installment which runs June 3 through June 15 2021.

How Is A Tax Bill Calculated Tim Brophy

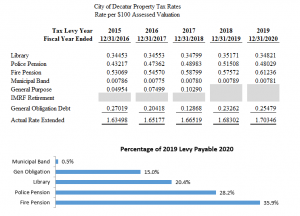

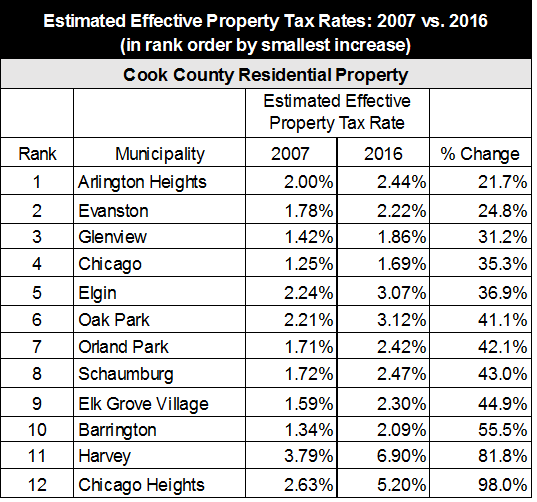

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Will County Il Property Tax Getjerry Com

Cook County First Installment Property Tax Bills Due March 1 2022 Village Of Barrington Hills

Online Payment Processing Guide Tim Brophy

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Online Payment Processing Guide Tim Brophy

Online Payment Processing Guide Tim Brophy

Online Payment Processing Guide Tim Brophy

Online Payment System Tim Brophy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates