cryptocurrency tax calculator reddit

So unrealized gains 600 - 200125 275. On your tax return for that year you should report 200 of ordinary income for receiving the Litecoin in January and a short-term capital gain of 200.

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

As the cryptosphere gained more traction revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax.

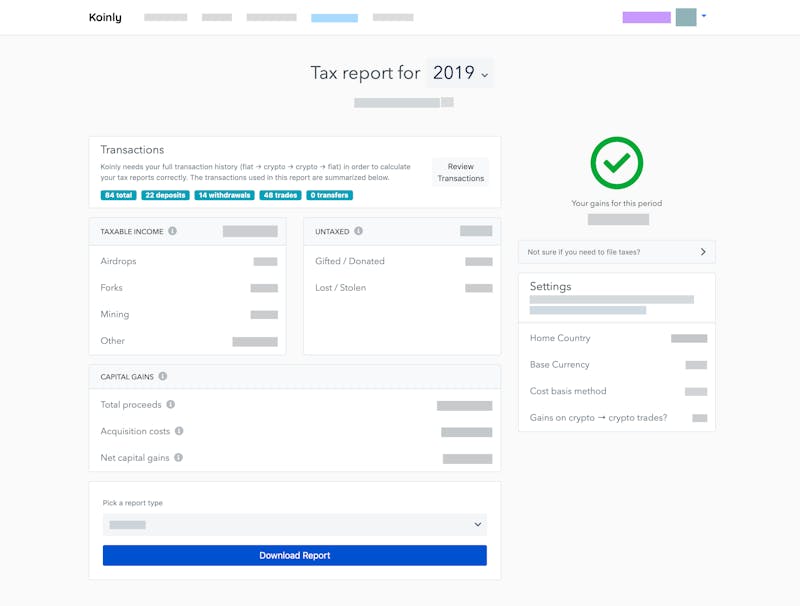

. Since then its developers have been creating native apps for mobile devices and other upgrades. Giving power to people. First year filing crypto and I handed over all my crypto tax forms from Koinly Schedule D and 8949 to my CPA earlier this week who admittedly is a bit of a boomer and has very little knowledge of crypto.

Tax-Loss Harvesting With A Crypto Tax Calculator. Check out my free to use tool. In the US the cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate.

Whether you are a taxpayer looking to get an accurate crypto tax report a business looking to track your inventory or an accountant trying to work your way through a maze of transactions. Investors traders miners and thieves. The original software debuted in 2014.

So I explained to him that I used software to calculate my crypto capital gains which is shown on the Schedule D. Note that each state can have its own capital gains tax. Decentralization is so important due to so many reasons - the main one being freedom.

Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. At any moment centralized cryptocurrencies can suspend transfers or create 100 million more tokens making your stack worthless. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Initial purchase price of 5 x 25 units 125. Do not endorse suggest advocate instruct others or ask for help with tax evasion.

In 2021 it ranges from 10-37 for short-term capital gains and 0-20 for long-term capital gains. CryptoCurrency Memes News Discussion TA. 12570 Personal Income Tax Allowance.

It looks like this post is about taxes. The USA IRS states on their website The sale or other exchange of virtual currencies or the use of virtual currencies to pay for goods or services or holding virtual currencies as an investment generally has tax consequences that could result in tax liability. Long term it tends to be that you dont have to pay taxes for your first 40k or whatever number the gov sets per year.

Coinbase releases cryptocurrency tax calculator cryptocurrency startup coinbase has launched a new gainloss calculating tool as part of an effort to help its user base keep up with us. For example you might need to pay capital gains on profits from buying and selling cryptocurrency. Cryptocurrency cryptocurrency-list cryptocurrency-market cryptocurrency-meaning cryptocurrency-mining cryptocurrency-news cryptocurrency-prices cryptocurrency-reddit cryptocurrency-tax-calculator Leave a comment on How to Start Doge Coin Mining.

The cryptocurrency tax calculator youll enjoy using. Remaining units 75-50 25 so we need to include 25 units from the earlier sale to calculate our start balance. They compute the profits losses and income from your investing activity based off this data.

Cryptocurrency is a way for a decentralized financial system. This allowance was 12500 for the 20202021 tax year. Your income bracket and how long you have held the cryptocurrency.

UK crypto investors can pay less tax on crypto by making the most of tax breaks. 110k members in the CryptoCurrencyClassic community. This is a site wide rule and a subreddit rule.

A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins. But note this could push you to a higher tax bracket for your income tax. In my opinion at the tax year end you should NEVER have unrealized losses.

Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. Gains and losses are calculated in your home fiat currency like the US Dollar to help you file your taxes with ease. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

Subscribe to cryptotrader tax at up to 20 discount priceredeem our coupon code for extra 10 off plus free trial. Thats the 400 value of your Litecoin when you purchased the plane tickets minus your 200 basis when you received the Litecoin. Those two cryptocurrency transactions are easy enough to track.

Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. The unofficial Wild Wild West of rCryptoCurrency. Crypto tax breaks.

Koinly has got you covered. Cryptocurrency Tax Calculator. In the US crypto-asset gains are calculated using two factors.

Please note that Rule 4 does not allow for Tax Evasion. Taxing agencies consider cryptocurrency as property and therefore taxable. Your first 12570 of income in the UK is tax free for the 20212022 tax year.

CoinTrackinginfo - the most popular crypto tax calculator. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. This matters for your crypto because you subtract this amount when calculating what.

Posted by donm196830 March 16 2022 Posted in Uncategorized Tags. Short term capital gains tax income tax. CoinSutra Cryptocurrency 6 Best Crypto Tax Softwares 2022 Calculate Taxes on Crypto Cryptocurrencies brought four main groups together.

Is Bitcoin A Bubble Graphics Card Bitcoin Calculator Itunes To Bitcoin How To Sell Bitcoin For Usd Best Bitcoin Cryptocurrency Bitcoin Wallet Bitcoin Mining

How To Declare Cryptocurrencies On Your Taxes In Canada By Iskender Piyale Sheard Medium

Cryptocurrency Taxes What To Know For 2021 Money

Bit Coin Bitcoincryptocurrency Cryptocurrency Trading Cryptocurrency Bitcoin

How To Calculate Crypto Taxes Koinly

Understanding Cryptotax Calculator Reports R Bitcoinaus

Why Cryptocurrency Is The Future Satoshi To Bitcoin Cryptocurrency Buying Guide Bitcoin Exchange Usd Bitcoin Classic Bitco Cryptocurrency Bitcoin Bitcoin Price

Bitcointaxer Org Open Source Crypto Tax Calculator And Portfolio Tracker R Cryptotax

Coinboard On Twitter Bitcoin Crypto Money Cryptocurrency

Crypto Com S Free Tax Calculator R Cryptocurrency

Are Wrapped Crypto Tokens Taxable Koinly

How To Calculate Crypto Taxes Koinly

Cryptocurrency Tax Reports In Minutes Koinly

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

The Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Calculate Crypto Taxes Koinly